How restaurants buy: The structural matrix that shapes your GTM odds

Most restaurant tech GTM plans are great… until they’re not.

You’ve got the right pricing. Your reps are trained. You’re playing by the quadrant rules from Part 1, where we mapped your GTM motion across pricing model and mandate leverage.

But you still can’t get traction. Or worse, you land a logo, only to realize rollout is blocked, slow, or optional.

That’s because your GTM motion is only half the story. The other half is how your target brands are structured, and how that structure limits or enables adoption.

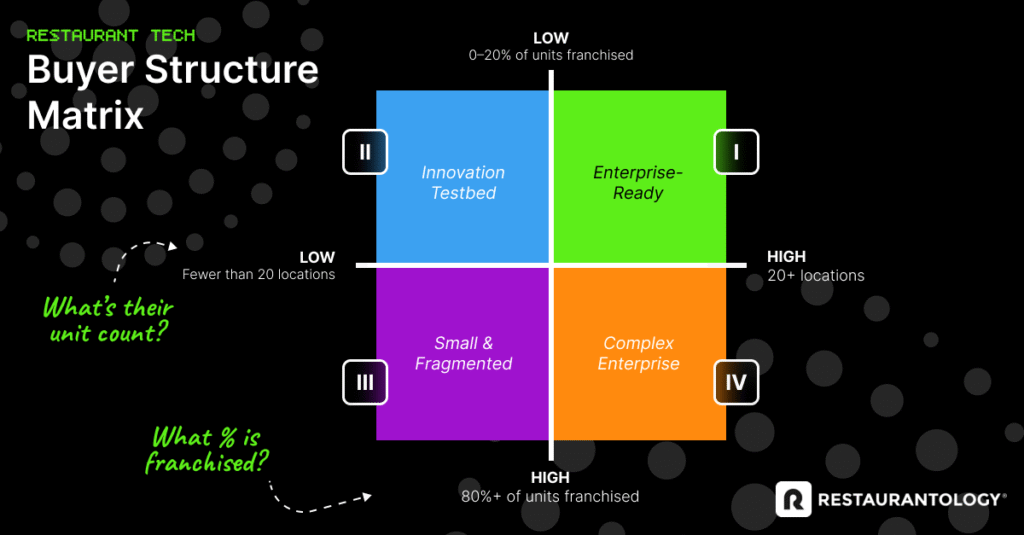

The buyer structure matrix

Two factors influence how much control a brand has over technology adoption:

X-axis: Unit Count (Low, fewer than 20 locations ←→ High, 20+ locations)>

Y-axis: % Franchised (High, 80%+ franchised ←→ Low, 0–20% franchised)

The quadrants

These four buyer types emerge when you combine unit count and franchising structure. Each has different implications for speed, scale, and effort.

Quadrant I: Enterprise-Ready (High Units + Low % Franchised)

This is the ideal buyer. Decisions are made at HQ, and rollout is enforced across the brand. Great for scalable GTM and reliable expansion. Your CAC model thrives here because once the deal is signed, revenue is predictable.

Quadrant II: Innovation Testbed (Low Units + Low % Franchised)

Quick decisions. Often founder-led or run by small corporate teams. These brands tend to be open to pilots and new tools. You’re selling to decision-makers, not gatekeepers, but you’re only unlocking a few rooftops at a time.

Quadrant III: Small & Fragmented (Low Units + High % Franchised)

This is the toughest buyer segment. There’s no TAM leverage and no central authority. Every decision happens at the store level, and those stores may not even share systems, owners, or incentives.

Quadrant IV: Complex Enterprise (High Units + High % Franchised)

You’ve got TAM, but sales are complicated. Corporate may influence stack decisions, but can’t enforce them. Even if you land corporate alignment, adoption depends on field relationships, approved vendor lists, or slow drip transitions.

Why this matters

Knowing your GTM quadrant is powerful, but it’s incomplete without knowing your buyer structure.

Imagine two brands in your CRM. Both have 200+ locations. One is Quadrant I: centrally owned, ready to roll. The other is Quadrant IV: franchise-heavy with zero mandate power. Treat them the same, and one converts while the other burns cycles and quietly lands on your AE’s don’t bother list.

Structure impacts everything:

- How many stakeholders are involved

- Whether corporate budget = store spend

- Whether your rep can close or just “influence”

- Whether success is measured in bookings or actual adoption

And yet, most teams ignore it. Year after year, reps are handed SKO targets—and quota—based on logo count, not structure. Boards and CEOs with limited foodservice experience assume every brand with 100+ units is “enterprise.” They assign a rep to chase 50 of them even when 0% can mandate tech across the system.

Here’s the reality:

As unit count increases, the percent franchised approaches one.

The bigger the brand, the less control it often has. Ignore that, and you set up your team to fail.

It’s a self-fulfilling prophecy. The rep misses quota. The product seems to underperform. And the board assumes it’s a sales problem.

One more wrinkle: structure varies by category

A brand might be Enterprise-Ready (Quadrant I) for one product but yet Small & Fragmented (Quadrant III) for another, something that most vendors miss or fail to account for appropriately.

Example: A 100-unit chain might mandate a single POS system, but leave scheduling or marketing tools up to each operator.

Scaling isn’t just about the brand, it’s about the category you’re selling into.

We’ll explore that in Part 3 for our GTM Clarity series—how category shapes GTM—where we’ll talk about why your TAM might shrink or expand depending on which product you’re selling.

Use buyer structure to target smarter

Before you chase that next logo, pause.

Ask:

- How many locations do they have?

- How franchised is the model?

- Who actually decides?

Restaurantology’s platform gives you visibility into brand structure before you build the sequence. The install base doesn’t just tell you how big the opportunity is, it tells you how hard it’s going to be.

Up next in Part 3 → Category Shapes Structure.