Is the restaurant industry’s expansion rate quietly cooling?

Amid mixed macro signals, is restaurant growth quietly cooling?

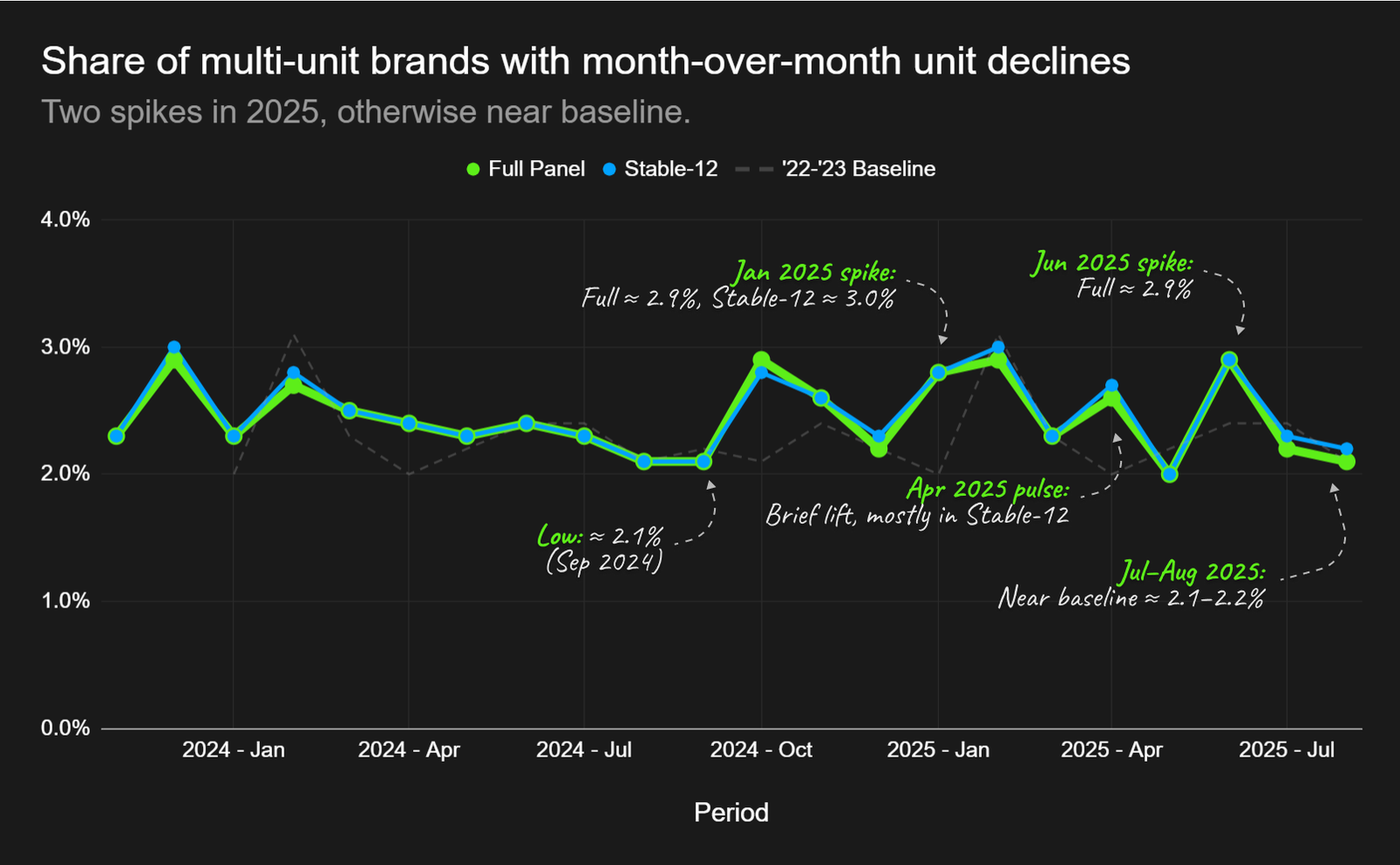

Two above-baseline spikes in month-over-month contractions appear in 2025—January and June—while most other months sit near seasonal norms. Expansions still outpace closures, and net unit change remains modestly positive. That reads as cooling at the margin rather than a broad pullback.

Data

What the chart shows

- Two spikes in 2025: January and June.

- A brief pulse in April, then July and August near baseline.

- Stable-12 mirrors the shape, so the signal is not entry or exit noise.

- Size-weighted loss share is higher in Q2, which means cuts were a bit deeper when they occurred.

How to read this

Cooling is mild and concentrated in SMB and mid-market. IND is steady. ENT trims frequently, but the average monthly cut is small.

Growth context

Expansion frequency remains in its historical band. Growth Rate has held in the low-to-mid 3 percents in 2025, consistent with 2022–2024, and size-weighted adds are roughly one-half of one percent per quarter. The cooling shows up on the contraction side.

Implications

Where dollars lean when posture tightens

- Buyers bias toward levers that increment sales: marketplace visibility, cleaner digital storefronts, and promo mechanics that promise volume.

- Efficiency platforms still win when the path to revenue is explicit. Pure cost savings require a clear traffic or sales tie-in to earn priority.

Who is most affected

- SMB and mid-market are where most vendors sell, and these tiers are the most volatile in our read. Expect more scrutiny on ROI claims that do not tie to guest demand.

- IND looks resilient. ENT is pruning, not retreating, which reads as discipline rather than distress.

Timing

January to February and September are historically choppy. Plan GTM pushes that respect those rhythms and speak to near-term revenue impact during tight windows.

Conclusion and what to watch

The broader U.S. economy continues to show resilience through repeated shocks. Our panel reflects that resilience. Expansions still outpace closures, and the cooling in 2025 is episodic rather than continuous. Cost pressure, financing, and demand variability can compound, so future months will tell whether this remains pruning at the margins or begins to accumulate. A correction is possible, not guaranteed. We will keep tracking the signal and call it if posture changes.

What would constitute a shift from pruning to pressure

- Global Decline Rate holds above ~3.5 percent and is rising on both the full panel and the stable panel for two consecutive quarters.

- SMB climbs above ~3.8 percent while mid-market exceeds ~11 percent at the same time for two consecutive quarters.

- Size-weighted loss share remains materially elevated for two quarters.

- The signal broadens across segments rather than a single-tier pulse.

We will refresh this view quarterly and publish the same chart plus a short readout. If thresholds remain untriggered, expect net-additive growth with occasional tightening. If they trip, we will say so plainly and adjust the GTM implications accordingly.