7 steps to streamline sales territory planning

We’re halfway through what most call their fiscal year, and if your brain is starting to wander towards FY2023 planning, we don’t blame you. Companies big and small often use August and September to set budgets, validate headcount and quotas, and begin carving out what better, more focused version of their existing territory plan needs to exist for a more profitable future.

Since the hospitality industry changes rapidly, it should give you even more reason to re-evaluate how you sell into the restaurant space. For instance, certain markets fall victim to changes in legislation, whether it be employment or economy-driven. Your product could either be the solution for restaurateurs to manage each change, or this could be the ideal time to pull out of a specific territory if it no longer holds value for your future sales.

What is sales territory management? Gartner defines territory management as: the process by which sellers prioritize and manage a group of customers and prospects, who are typically organized by segments

You have to know the latest demographic, technographic, and firmographic data of your target audience. Then find the selling potential, then align your commercial team to the right vision and goal of each sales play. While this is by no means a simple process, it doesn’t have to be a painful one. Below, we’ll guide you through the essential steps of creating the ideal territory map for your sales team.

[01] Define TAM vs ICP to fuel the sales engine

As much as we’d like to believe, the product you are selling can’t be everything to everyone. The restaurant industry is heavily franchised, is made up of over half independents, and has people entering its workforce with no previous experience – more than ever. The key to your selling success is focusing on where you can win, fast.

- Understand your Total Addressable Market or TAM, which is an exercise in defining the total market demand for your product category.

- Using a bottoms-up analysis, work with other commercial departments to identify where your product can provide the most value, and where it won’t.

- Then you can start segmenting the TAM based on certain pain points, geography, and/or estimated revenue to hone in on your ideal customer profile, or ICP. The major difference between the two: assessing the available market for a solution like yours vs targeting specific characteristics of the market where you know you can win. Additional ICP considerations:

- size (unit count)

- service type

- trading area

- tech stack details

[02] Define roles & responsibilities

Your company likely has the roles and responsibilities of each team defined, but when it comes to planning for growth, restructuring becomes instrumental to achieving your goals. For example: if your new sales strategy involves entering adjacent markets for the first time, you won’t have benchmark data to gauge YoY performance. How many resources are you willing to allocate to this new sales play? The answer: enough so failing won’t hurt and success can be proven – then replicated – quickly. Align with your commercial leadership on:

- How many reps do we need to support the complete sales cycle based on the full market potential (TAM), our serviceable available market (SAM), and who we’re targeting (SOM, aka ICP)?

- What type of selling will work best – hunters, farmers, or hybrid?

- How many reps do we need with this skill set?

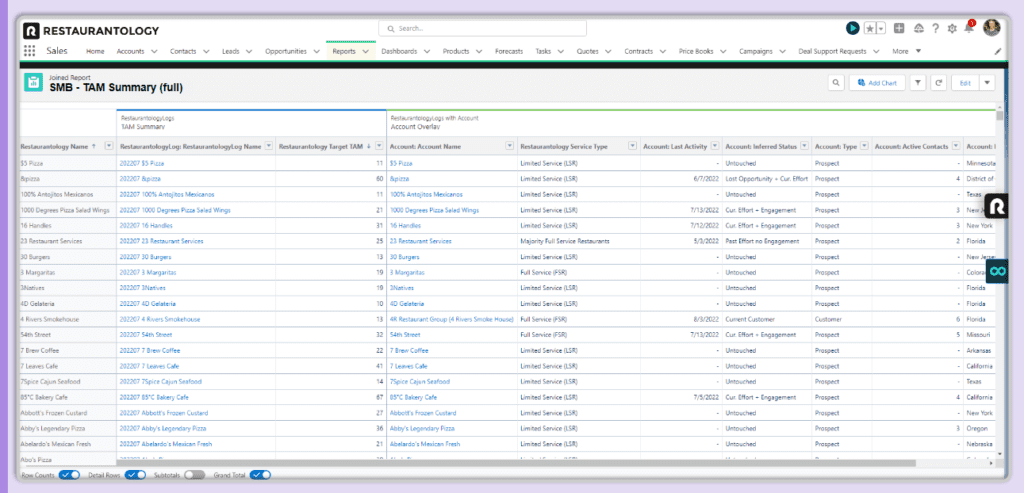

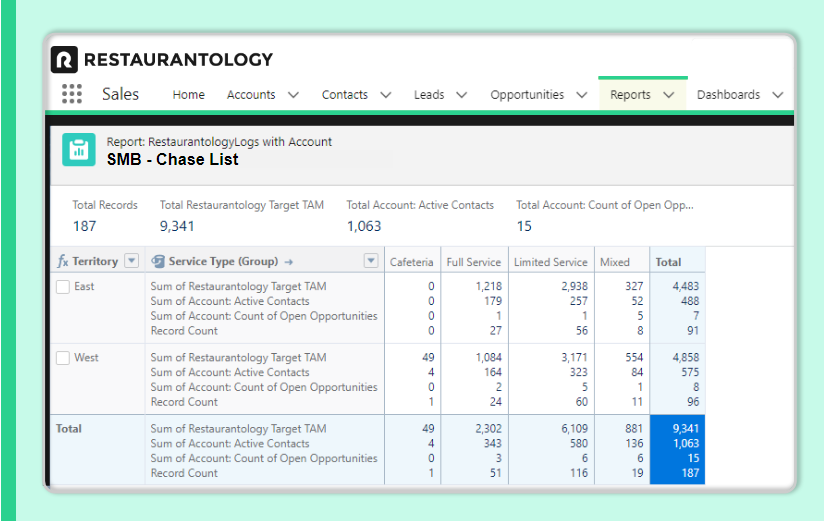

[03] Assess your on-hand data

Every day, you’re pulling in data from several sources. However, the timeliness and accuracy of the data is less predictable. Kudos to you if your team has the bandwidth to scrub every report and data point before it gets ingested into your CRM (like spending hours on an internet search to validate a prospect’s account information). Unfortunately, the majority of sellers don’t have that luxury. Sales teams are hired to sell, not to be inundated with manual data entry – so how can you get them information that is specific to their territory, is reliable, and actionable? When assessing the data you have readily available:

- Make sure you aren’t just collecting widely available information like a business phone number and email. These inquiries are typically received by a frontline team member, and not the decision-maker your team is looking for.

- The data points that will drive your territory assignments, like geography or location count, must also be available in your CRM, and they must be clean/credible.

- Your reps must be able to easily identify and filter through the components of each territory to sell effectively. If you aren’t collecting the right account information, your territory assignments and sales plays won’t perform the way you intended them to.

[04] Check for quality and equality

One of the top complaints of an underperforming sales team: “I wasn’t set up for success.” Brands have to provide clarity on what the goal is, a means to obtain that goal, and a way to measure the effectiveness of each team’s actions. As part of the process of defining territories, you have to answer:

- Will everyone have a fair chance? Short answer, no. But you can get close by looking at the revenue-potential for your pre-determined segments and performing a risk assessment. For example: those territories with higher revenue potential, but smaller whitespace carry a high-risk, high-reward selling cycle. You won’t want to assign too many reps to this part of the market but you will want to assign someone more senior and strategic to manage. As for the rest of the team focused on the lower end of the market – it might seem unfair, but because the risk is low, they actually have an advantage as there will be more predictability in how sales perform.

- Taking the above into consideration – if the sales territories vary, and the selling approach varies, then you shouldn’t take a blanket approach to setting quotas and instead adjust them to match the market value you’ve defined in steps 1 to 3.

[05] Avoid common shortcuts when delivering a territory list

As tempting as it is, simply telling your sales rep Sam that he now owns the North East and is responsible for the 1-9 space is not proper territory management.

- Don’t set the objective without proper direction or your team will quickly become frustrated and unmotivated.

- Make sure your team knows how to use the tools available to them to make their job easier. A lot can be automated these days – from the kind of data that gets captured to the cadence of touch points your team is responsible for. Less admin time = more time to sell.

- Don’t let critical data sit in disjointed places. I.E. if you find yourself downloading a contact list and uploading to Google or Excel, stop.

- The actions your team takes won’t be detectable.

- You’re forced to rely on their manual data entry.

- You’re putting data integrity at risk if someone mistakenly changes a field or column in the raw spreadsheet.

Ingesting restaurant insights directly through your CRM is an automated, hands-free way to enrich your database. This direct integration gives your team the granularity they need, with the reliability you need to ensure the information they’re using is accurate and timely.

A popular school of thought: “If it isn’t in the CRM, it doesn’t exist.”

Another popular school of thought: “Set it and forget it.”

[06] Measure effectiveness, and tweak when necessary

It’s time to advance how we sell in the 21st century. After all, sellers and buyers alike are expecting a more refined, personalized experience throughout the sales process. Even unseasoned reps should at least:

- Look to see if there was already account information in our CRM before reaching out

- Incorporate the account information on hand into each outreach

- Track the effectiveness of their actions

Using platforms that integrate with your CRM, like Groove, will help automate sales conversations and consequently how your team reports on these metrics. The more functions a rep has to manage, the less effective they will be. Keep each team focused on their ICP wants and needs, so when tracking the performance of a new territory you can quantify impact and make iterations as needed.

Impact-driven metrics:

- How quickly did they take action on a new opportunity?

- Is their sales cycle length improving?

- Is the average deal size increasing?

Use your CRM as the single source of truth for measuring sales performance. You can quickly hold reps accountable for their actions and ensure the handover process at each stage of the sales cycle is clear and consistent across departments.

[07] Practice agility throughout territory planning

We’ve come to our final step – which can also be identified as your reminder to “don’t put all your eggs in one basket”. It’s easy to overspend and over allocate resources to a specific sales play or territory. With a solid plan and internal alignment, you might be itching to assign out all the accounts that fall within your ICP to get the biggest return. However, you should never reveal your full hand this early on in the process.

In order to give your sales plays room to grow:

- Only assign a subset of accounts. You should always have a reserve you can dip into when necessary. Reasons why you may need a bank of unassigned accounts:

- A new rep that needs to practice cold pitching.

- A rep whose territory is underperforming, perhaps due to unforeseeable circumstances. If they can’t hit quota on their territory, they’ll likely quit.

- A rep with a great territory but they’ve lost several strategic deals one after the other. With an influx of fresh accounts to chase, they will have the perception of having more cycles to manage or they could spiral into a performance lull.

- A portion of the market that has a higher risk of return, but might loosely fit your target audience.

- Regularly check in to your CRM to ensure you have sufficient coverage across markets. With your subset of accounts, you should be able to prove what percent of those accounts are currently being worked and alternatively, what portion has been abandoned.

Remember: some of the best business decisions are defined by the territories you create.

If you have the right data feeding into your CRM and clearly understand your ICP, you and your team won’t ever have to get lost in the details so you can focus on what matters.