Online restaurant reservations continue trend toward data sharing

30 years after the first reservations were booked online, restaurants are wising up and requiring first-hand access to their guest’s data.

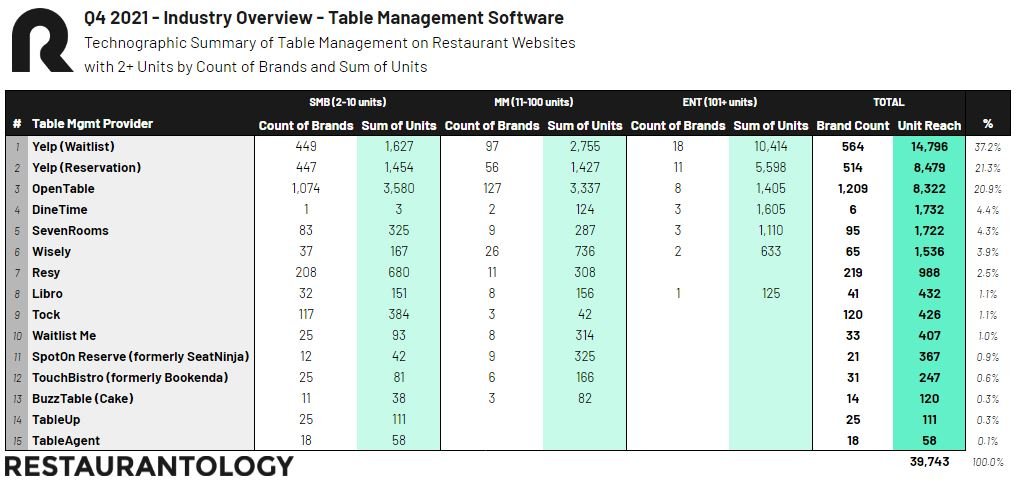

As of Q4 2021, roughly 15% of known multi-unit (2+) brands had an online waitlist or reservation strategy, be they full service, fast casual, or anything in between.

Here’s a breakdown of the Top 15 key players in this space:

Based on these insights, there are 3 crucial assumptions we can make:

[01] Consumer brands continue to own a healthy share of the market

OpenTable, Yelp, and Resy continue to be the most recognized names in the online table management space. With strong brand recognition and vast networks, restaurants continue to partner with these three brands despite sacrificing both brand identity and direct marketing capabilities in exchange for “being discovered” in their respective marketplaces.

For smaller companies, this seems to be an acceptable trade off, as they sometimes lack the tech stack, marketing muscle, or budget to manage customer data internally. Bigger companies, however, are allowing OpenTable, as an example, to directly market to their guests on their behalf, where the logo and messaging cannot be controlled, and the guest feedback often doesn’t make it back to the restaurant managers capable of responding, if needed.

[02] Companies offering restaurants their guest’s data are challenging the status quo

Recognizing the continued trend towards wanting to own all relevant customer data, smaller tech companies are offering white-labeled, flat-fee table management solutions that challenge the existing business models of OpenTable, Yelp, and Resy.

For years, restaurants have struggled with OpenTable’s pay-per-cover pricing model, and with many of the nation’s biggest FSR’s jumping to smaller platforms like SevenRooms (Bloomin’ Brands) and Wisely (First Watch and PF Chang’s) who offer them their guest’s data, it seems that the Overton Window is finally shifting towards a newer version of what is deemed “acceptable” when partnering with a third-party software solution.

[03] We will continue to see competition and consolidation in this space

POS companies like TouchBistro, SpotOn, and Cake have made strategic acquisitions of restaurant reservation software start-ups Reso, Bookenda, SeatNinja, and BuzzTable. Last year Wisely was acquired by Olo in its first purchase as a public company since its IPO in early 2021.

OpenTable and Yelp appear to be catching on to their customer’s needs as they begin to revamp product offerings to include increasing amounts of guest data. As more and more companies are finding how easy it is to move away from these big names, it will be interesting to see how far they will be willing to bend to keep their fair share of the market.

Notes about our data

Restaurantology currently collects and analyzes public multi-unit restaurant data for the US and Canada. Restaurantology insights are intended to help our customers have a better, more strategic understanding of the hospitality industry. Our data can help reduce the time from insight to action via a unified body of knowledge that customers can search, browse, and use as they see fit.