How to qualify multi-unit restaurant brands in under 10 seconds

The modern restaurant qualification process is better, faster, and likely takes place before your sales rep even picks up the phone.

In a typical sales cycle, that is one that follows the traditional qualification → discovery → solution alignment → pricing / negotiation → won / lost cadence, the first step before investing both effort and energy into a full-fledged sales cycle is to qualify whether or not the prospect fits the definition of your Ideal Customer Profile (ICP). Historically, this process happens between your sales rep and the buyer, likely over the phone in a series of transactional fact-finding questions to determine whether they possess the characteristics that make them a good fit for your product or service.

The problem with qualification in the foodservice industry

For the past 2 decades, sales organizations have been using a combination of brute force and elbow grease to qualify restaurant prospects for things like ownership hierarchies and tech stack details. Some companies hire and train MDRs and SDRs to document their findings so they can better segment the industry. Others try external partners to append data via snapshot list purchase(s) when CRM data is deemed insufficient or unbelievable.

There are several existing problems with the way many companies seek to qualify foodservice opportunities:

- Getting 2 people to set aside time for a for-purpose qualification call is increasingly difficult. Everyone is busy.

- The prospect must be knowledgeable about their business, and must be willing to share information freely.

- Many prospects expect sales rep to do their homework. Manual fact finding is difficult and hardly scalable.

- Sales reps must commit to the qualification process, and must document their findings.

Any seasoned sales manager will know that each of these poses great risk on its own, and together can create a bit of a “perfect storm” that cripples the sales cycle just as it’s starting.

Let’s go a level deeper…

Scheduling

Overall, getting dedicated time from a restaurant manager to commit to a phone call is rare. And if they do commit, there’s a high percent chance they unintentionally or intentionally no show, perhaps because there is quite literally a fire in the kitchen.

Qualifying

When or if they do show, properly qualifying the restaurant as a prospect can often be difficult, as many operators either lack the knowledge to speak to certain aspects of their overall operations (they might not know who provides their seasonal prawns, the name of their WiFi service, or what geofencing is) or they may simply be trained to withhold divulging certain pieces of information or from engaging in sales-like conversations. In short, qualification call attendance is rare and the results are often painstaking or fruitless.

Prepping

Preparing for your qualification call can also be tough. The internet is full of public data, but browsing through public profiles, websites, and any other information you readily consume is time consuming. And like Googling, searching through details and extracting valuable insights is a skill. An ordering page may not expressly state “we partner with DoorDash” and the Loyalty sign up often doesn’t say “Mailchimp sends our emails.” Sales reps need to know what they’re looking for to be effective qualifiers.

Emphasizing

Lastly, sales reps often try to blend the qualification process into a discovery or, worse, demo call, often in an attempt to shorten the sales cycle and skip to the “storytelling”… aka the fun part. Ultimately, this can slow down deals that are under-qualified once a crucial integration gap is uncovered or upon realizing that the right decision makers weren’t previously identified and invited to the call. Fast-moving AEs are also likely to improperly document what they learn in the CRM, meaning loss reporting and implementation handoff are going to be rocky. This, of course, is the direct result of the DNA of high-performing sales reps often lacking the wherewithal for ongoing data entry.

Modern sales qualification of restaurants can be largely automated

In the restaurant space, most of the information typically collected during a dedicated qualification call can be gathered freely provided you know both where to look and what to look for.

More specifically, recent restaurant qualification often buckets findings into 2 specific facets of their business:

- Firmographic insights, such as how many locations they have, where they are based, what service style they offer, and more

- Technographic insights, such as what POS, order & pay, delivery, or various other software providers they use or partner with

Nowadays — with the right partner and a meaningful way to extract, analyze, interpret, and strategize relevant insights — the restaurant qualification process can largely be automated, for an ever-increasing portion of the foodservice industry.

Let’s see what that looks like…

[01] Firmographic Insights

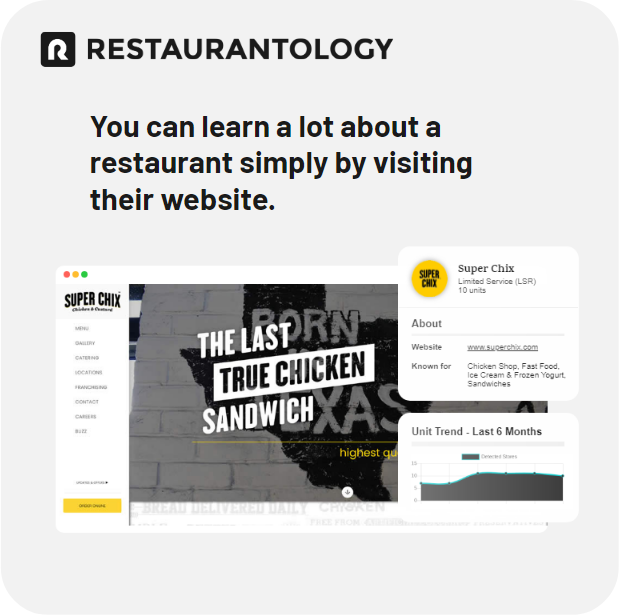

An increasing number of multiunit restaurant operators have a unique, clearly identifiable website that helps run their business. You can thank companies like BentoBox and Popmenu for that.

These websites provide a trusted, reliable means of extracting incredibly valuable data at scale, such as:

- Unit count, easily verified on a Locations subpage.

- What they’re known for, inferred from things like the type of establishment, the style of food preparation, overall cuisine, and the food offered.

- Service Type, where you can run an algorithm off what they’re known for to make an incredibly intelligent best guess.

- Ownership hierarchy, such as franchising or having a larger parent organization that owns the brand.

- Territory, such as predominant states or even urban areas or metros where their locations are concentrated.

Over time, websites can be visited repeatedly to track changes, document findings, and boil down all the relevant information into a single, predictable profile that allows you to consume the best, most relevant firmographic details in under 10 seconds.

This is what it looks like in action:

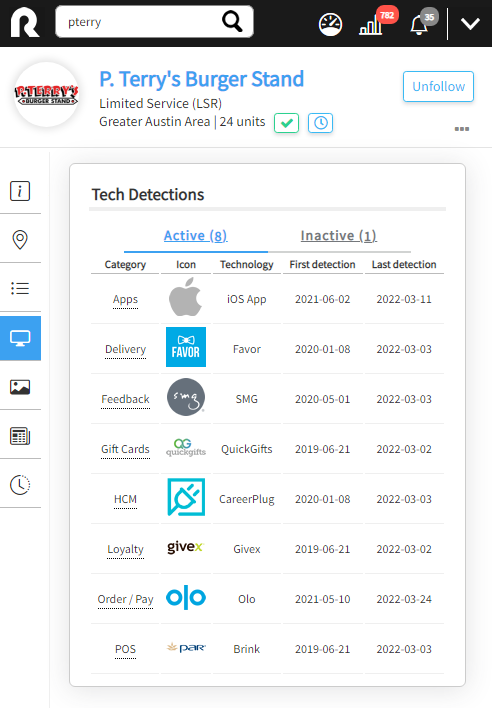

[02] Technographic Insights

Just like publicly available firmographic details, multiunit restaurant websites are also a treasure trove of tech stack details that can directly connect you to the brand’s approach to building out their overall guest experience.

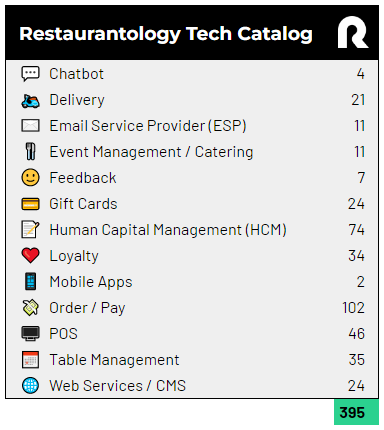

This can cover a variety of software types and over 400+ unique fingerprints that can be detected and tracked via automation over time.

Conclusion

The mass exodus of the industry’s more traditional and established leaders paves way for a new reign and era of hospitality. As the market’s health stabilizes, the needs of your ICP are changing. The new guard will be looking to make their mark, uprooting antiquated systems in favor of modern solutions that meet the needs of businesses and consumers today. Automated FOH and BOH roles, customer feedback technology, and a consolidated tech stack will take priority and bring the biggest growth opportunity for sales as long as they know what to ask, when, and why.

Notes about our data

Restaurantology currently collects and analyzes public multiunit restaurant data for the US and Canada. Restaurantology insights are intended to help our customers have a better, more strategic understanding of the hospitality industry. Our data can help reduce the time from insight to action via a unified body of knowledge that customers can search, browse, and use as they see fit.