Restaurant CMS analysis (Q1 2022)

From large incumbents to smaller industry-specific partners, restaurateurs face no shortage of options when choosing how to build their online presence.

For the past 2.5 years Restaurantology has been following nearly 12,000 multi-unit (2+) restaurants in the US and Canada. Our goal is to track month-over-month unit growth, tech stack trends, and more.

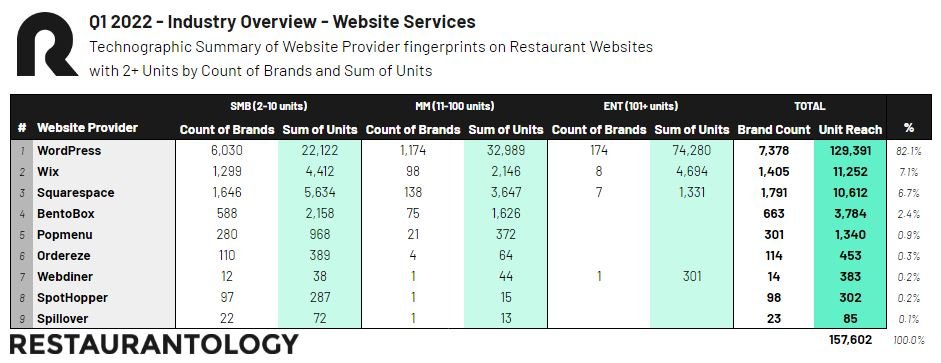

As part of the detectable tech universe, we’ve focused this analysis on 9 Content Management Systems (hereafter “CMSs”), 3 big and 6 new/niche, that most operators choose from when building or reshaping their website.

Note: In addition to the 9 core providers in this CMS tech analysis, there are also POS companies (Square) and online ordering providers (Slice, Menufy) who are ready, willing, and capable of building for-purpose websites in the restaurant space. They were intentionally excluded from this overview, as they were already included in our POS and Online Ordering summaries earlier this year.

4 reasons why restaurants need a website

First things first: successful restaurants need a good website. We believe this to be something of a universal truth. After all, it’s estimated that 90% of guests research a restaurant online before visiting, 57% of which viewed the restaurant’s website before selecting where to dine. (source: Upserve)

Thus, restaurant websites can be mission critical for both budding or established brands, and drive and define four crucial elements that can ultimately help a restaurant business:

- Strengthen its brand identity by building legitimacy and trust while keeping their guests informed

- Increase discoverability to compete with larger and/or notable brands

- Diversify its revenue stream via digital sales (gift cards, online ordering, merchandise, reservations)

- Build long-term loyalty through digital marketing, online reviews, and actionable feedback

When done right, there’s lots to gain.

What operators consider when choosing a CMS

When it comes time to assess how to build or update their website, many restaurateurs are quickly thrust into the FAST-GOOD-CHEAP conundrum and asked to pick just two. This mindset leads us to three core considerations we believe operators make when choosing a CMS:

- Cost

- Ease-of-use (upfront and ongoing)

- Integrations

In short, the best website is one that is cheap, easy to maintain, and works with the systems they already use. Sounds amazing. This can lead to problems, though, in execution.

Here are a few real life examples:

- A DIY provider like WordPress or Squarespace, designed to empower restaurant managers with templates and widgets, gives potential diners a beautiful website when viewed on desktop, but quite the opposite when a customized plug-in loads incorrectly on a mobile device.

- An agency has on-staff designers who can code and match your brand identity, but sends a quote that doesn’t make sense for the business.

- A third-party provider can churn out a quick website for cheap, but it leaves very little room for custom branding (cookie cutter) and doesn’t natively integrate with any of platforms the restaurant deems necessary.

Finding the sweet spot between cost, ease/speed, and industry-specific requirements is defining the CMS purchasing decision.

To build or to buy… that is the question

The “build vs. buy” framework is absolutely appropriate for dissecting the mentality behind how restaurants establish and build their brands online.

By the data, bigger companies, with the internal muscle to customize every last website detail, continue to invest in building their online footprint from soup to nuts. They do this by partnering with the most well-known, non-industry-specific Content Management Systems, most notably WordPress. Several leading brands even go a step further, combining WordPress + Olo + Koala, where Koala boasts their ability to help “create premium, customizable apps that offer branded digital ordering.” If you’re curious to see what it looks like in action, here are a few brands who have implemented Koala in the past 6 months:

Smaller brands, such as those with less than 10 physical locations, also tend to build on WordPress rather than finding a third-party vendor, however in the past year are beginning to gravitate to SaaS providers who bundle additional web services into their offering, such as native POS, online ordering, and reservation integrations, digital marketing packages, and even reputation management services that help update social profiles, track online reviews, and solicit guest feedback.

These industry-specific partners appear to address all three of restaurant operator’s CMS purchasing worries: manageable cost, speed to implement, and relevant integrations. And if the past 12 months of CMS tech stack data is a leading indicator of what’s to come, we can expect this trend to continue.

Takeaways

There are quite a few conclusions we can draw from this dataset:

- 🥇 – WordPress, the world’s most popular website builder, continues to be the standard in the industry, with 82% of multi-unit restaurants in the US and Canada either directly or indirectly (perhaps via an agency) selecting it as their CMS of choice.

- 🥈 – Wix and Squarespace continue to represent a large portion of the foodservice industry, though both are trending down in the past 6 months, by 0.4% and 1.5% respectively. Key benefits continue to be cost for the former, and ease-of-use for the latter.

- ➡️ – SMB- and Mid-Market-sized restaurant brands are increasingly turning to companies like BentoBox to build their online presence. This is part of a continued trend of restaurateurs 86’ing their DIY CMSs and aligning their brands with more niche providers who better support required integrations in the restaurant space.

- 📈 – Popmenu, who last year raised $65M in Series C funding, has grown their multi-unit (2+) concept count from 246 brands in September 2021 to 301 in March 2022, a 22% increase.

Conclusions

Establishing and maintaining a high-impact online presence is undeniably important, though it’s no easy task for most restaurant managers. It’s difficult, it can be frustrating, and it’s time consuming. And in a world where there are literally fires in the kitchen, it’s easy to find digital marketing has been placed on the back burner.

The number one goal of a restaurant manager is to build sales. This statement, our second and final universal truth, is directly at odds with reality, one where managers battle 60-hour work weeks and razor thin margins. “It’s important, but not a priority.” Quite the prioritization paradox.

Notes About Our Data

Restaurantology currently collects and analyzes public multi-unit restaurant data for the US and Canada. Restaurantology insights are intended to help our customers have a better, more strategic understanding of the hospitality industry. Our data can help reduce the time from insight to action via a unified body of knowledge that customers can search, browse, and use as they see fit.